The cryptocurrency market has continued to evolve at an unprecedented pace. Bitcoin 2026 is capturing global attention as investors, tech enthusiasts, and financial analysts closely monitor market trends, price predictions, and innovative blockchain technologies.

From the meteoric rise of Bitcoin to the growing influence of altcoins and decentralized finance (DeFi) platforms, the crypto ecosystem is reshaping global finance.

This article provides a comprehensive guide to Bitcoin and the crypto market in 2026, offering in-depth insights, market analysis, investment strategies, and practical advice for both beginners and experienced traders.

1. Bitcoin Market Overview 2026

Bitcoin remains the flagship cryptocurrency, representing over 40% of the total crypto market capitalization. Experts predict increased institutional adoption in 2026, driven by:

Corporate treasury adoption

Payment integrations

Regulatory clarity in key markets

Current Bitcoin Price Trends

As of early 2026, Bitcoin has shown:

High volatility, typical for digital assets

Increasing correlation with macroeconomic indicators like inflation and interest rates

Periods of rapid growth followed by market corrections

Analysts emphasize the importance of long-term investment strategies to manage risks in this volatile market.

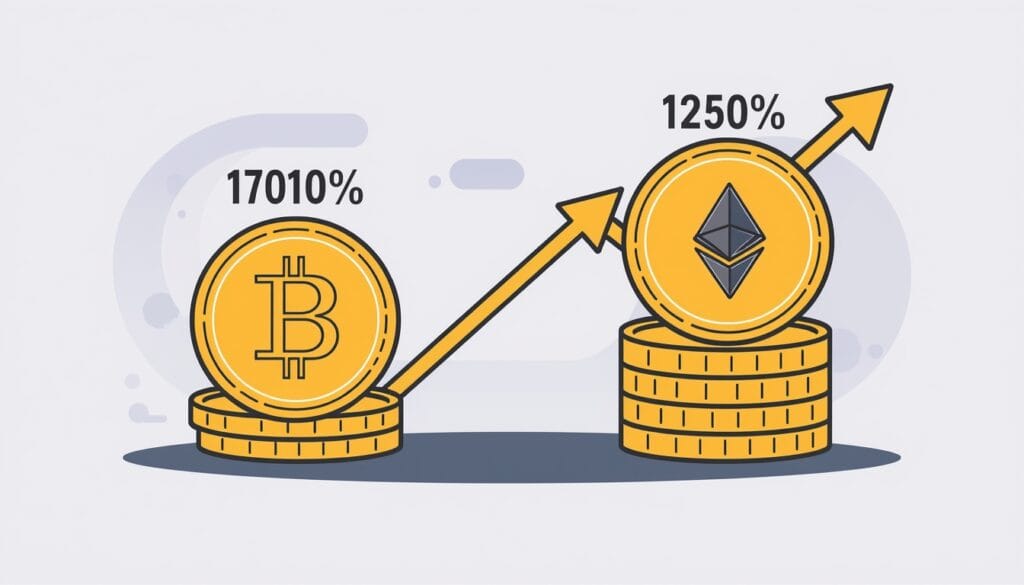

While Bitcoin dominates, altcoins such as Ethereum, Solana, and Cardano are driving innovation:

Ethereum 2026: Transition to Ethereum 2.0 with full proof-of-stake adoption

Solana: Growing ecosystem for decentralized applications (dApps)

Cardano: Focus on sustainable blockchain infrastructure

These altcoins often show higher volatility but can present significant growth opportunities.

3. Key Trends in the Crypto Market

Several trends are shaping the crypto space in 2026:

Decentralized Finance (DeFi)

DeFi platforms allow users to lend, borrow, and trade crypto without traditional banks. The market has matured, offering:

Yield farming and staking

Automated market makers (AMMs)

Multi-chain integration

Regulatory Developments

Governments worldwide are strengthening crypto regulations:

Tax clarity for crypto holdings

Anti-money laundering compliance

Stablecoin regulation

Regulation is expected to increase institutional participation while providing safety for retail investors.

NFTs and Web3

Non-fungible tokens (NFTs) continue to evolve beyond digital art, influencing gaming, real estate, and collectibles.

NFTs integrated with DeFi for liquidity

Tokenization of real-world assets

Community-driven governance models

Blockchain Innovation

Layer 2 scaling solutions for faster transactions

Interoperable blockchains enhancing cross-chain trading

Green blockchain initiatives to reduce carbon footprint.

4. Bitcoin Investment Strategies 2026

Investing in Bitcoin requires careful planning due to volatility and regulatory changes. Here are some strategies:

HODL Strategy

Long-term holding of Bitcoin through market cycles

Less frequent trading reduces exposure to emotional decisions

Suitable for investors confident in Bitcoin’s long-term adoption

Dollar-Cost Averaging (DCA)

Investing a fixed amount at regular intervals

Reduces risk of buying at market peaks

Popular among new investors

Diversification Across Cryptocurrencies

Balance portfolio between Bitcoin, Ethereum, and high-potential altcoins

Mitigates risks from single-asset volatility

Includes stablecoins for liquidity

Risk Management

Only invest what you can afford to lose

Use hardware wallets for security

Follow market trends but avoid impulsive decisions

5. Bitcoin Price Predictions 2026

While no prediction is guaranteed, analysts consider:

Institutional adoption may push Bitcoin price above $80,000

Macro factors like inflation and interest rates impact short-term price movement

Volatility will remain high, requiring careful timing for traders

Experts also emphasize technical analysis tools, such as moving averages, RSI, and support/resistance levels, to gauge market sentiment.

6. Crypto Trading Tips for Beginners and Experts

Stay Updated: Follow reliable crypto news sources and price trackers

Technical Analysis: Understand charts, volume, and indicators

Portfolio Tracking: Use apps to monitor multiple assets

Avoid FOMO: Emotional trading leads to losses

Security First: Enable 2FA and store crypto in cold wallets

7. The Future of Bitcoin and Cryptocurrency

The next decade will likely see:

Greater integration of crypto in daily payments

Central bank digital currencies (CBDCs) complementing decentralized coins

Wider adoption of blockchain technology in finance, healthcare, and logistics

Improved global regulatory frameworks enhancing market stability

Bitcoin is not just a digital currency anymore—it’s becoming a new asset class recognized by mainstream finance.

8. Risks and Challenges in the Crypto Market

Investors should be aware of:

Market Volatility: Sharp gains and losses

Regulatory Risks: Government crackdowns can impact prices

Security Threats: Hacking and phishing attacks

Scams and Rug Pulls: Always research before investing

FAQs

❓ What is Bitcoin?

Bitcoin is a decentralized digital currency that allows peer-to-peer transactions without a central authority.

❓ How can I invest safely in crypto?

Use regulated exchanges, hardware wallets, and diversified investment strategies like DCA and HODL.

❓ What is the crypto market trend in 2026?

Growing institutional adoption, DeFi, NFTs, and blockchain innovation are shaping the market.

❓ Is Bitcoin a good investment in 2026?

Many experts view Bitcoin as a long-term investment, but high volatility requires careful risk management.

❓ Is Bitcoin a good investment in 2026?

Market volatility, regulatory changes, hacking, and scams are key risks to consider.

Conclusion

Bitcoin 2026 represents an exciting era for investors and enthusiasts alike. With increasing adoption, innovative blockchain technology, and evolving market trends, the crypto market continues to offer both opportunities and challenges.

A well-informed strategy, combined with risk management and diversification, can help investors capitalize on this transformative digital financial ecosystem.

Whether you are a beginner or an experienced trader, staying updated, following trends, and understanding the market dynamics are key to success in the world of cryptocurrency.

1 thought on “Bitcoin and Crypto Market 2026: Trends, Price Predictions, and Investment Insights”